[ad_1]

In particular, Chromebook shipments fell sharply, down 51% year-over-year

Google is finally showing its love for tablets and other large-screen devices. After years of neglecting tablets, Android 12L invests in tablet-focused UI changes for the first time since Android 4.0 Ice Cream Sandwich. At the same time, Google has said that tablets are an important pillar of Android’s long-term strategy and that it’s ready to better support them — we even have a Pixel tablet. Hopefully, such renewed interest will give the form factor a bit of a boost: the tablet’s latest shipment numbers are in, and they show that Android tablets are (still) struggling.

According to newly released data from IDC and Strategy Analytics, the tablet form factor is now doing a lot more work.

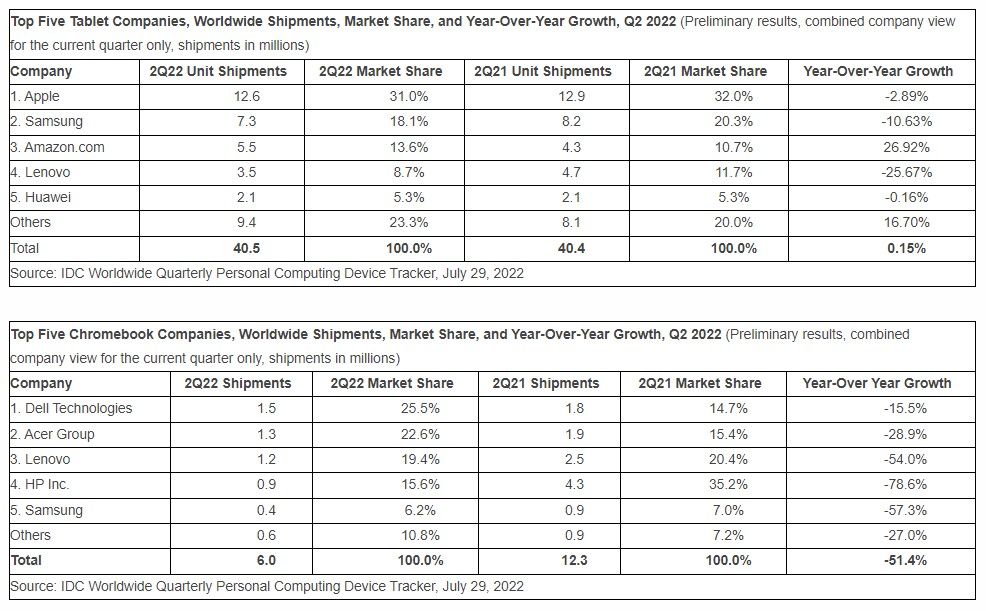

IDC data shows that the global tablet market grew by a slight 0.15% over the past year. Apple, Samsung, Lenovo, and Huawei all saw their shipments drop significantly, while Amazon seemed to notice some differences, as it saw a roughly 27% increase in shipments from the same quarter last year. Other smaller players like Xiaomi, Vivo and Oppo managed to grow revenues.

We’re just talking about tablets here — not about the software on them. Apple has lost roughly 3% since this time in 2021, but given that Samsung lost 11% when it launched the Galaxy Tab S8 series earlier this year, we think it’s a bad picture for Google. Lenovo dropped 26% when it released a new Android mid-ranger. Amazon and Huawei do not count Android™ Tablet manufacturers do not offer Google mobile services on their tablets at this time.

Meanwhile, if things look rough for tablets, it’s pure turbulence for Chromebooks. IDC also tracked a sharp Q2 drop in Chromebook shipments from major vendors, including HP’s 78.6% drop. Overall, Chromebook shipments fell 51.4% overall — meaning 12.3 million Chromebooks were shipped in Q2 2021, compared to just 6 million Chromebooks shipped in Q2 2022.

Does this mean no one wants to buy Android tablets or Chromebooks anymore? Are they just less attractive device categories these days? Not necessarily. Prolonged economic tensions and the war in Ukraine are likely to drive private purchasing decisions in general.

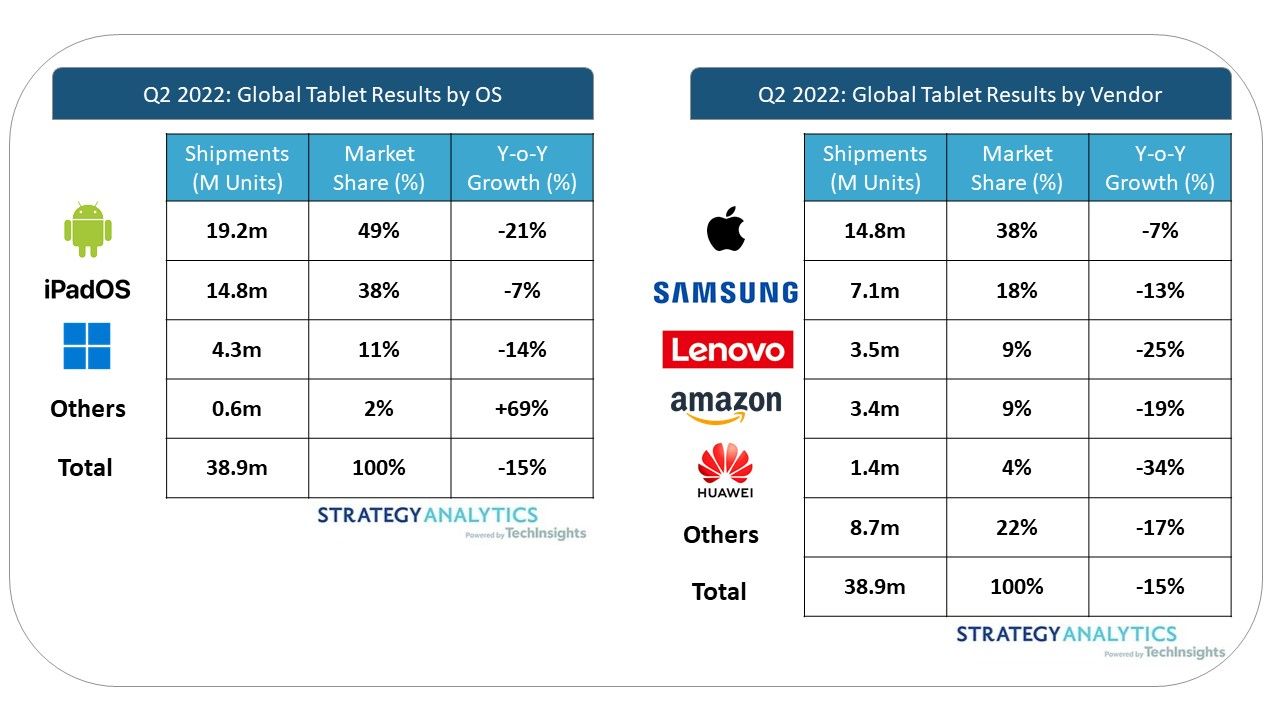

Meanwhile, a separate report from Strategy Analytics showed that Android’s share of the tablet market fell to 49%, falling from majority status for the first time in 10 years.

It is important to note that the analysts who prepared this report came up with very different numbers than those released by IDC. Strategy Analytics’ numbers reflect shipments to retailers, while IDC tracks shipments to distributors and end users. Strategy Analytics shows that Amazon shipments were down last spring, but the OEM may be waiting for the new Fire tablets to cycle to brick-and-mortar stores.

However, both reports share a common trend – demand for Android tablets has fallen along with the rest of the market. Apple also managed to increase its market share, rising 3.3% to 38%, despite seeing a decline in overall iPad shipments.

It’s too early to tell if doubling down on Android tablets will pay off for Google. Andorid OEMs join forces to create tablet experiences with OS really good again, and as the global economy improves, we expect these numbers to improve. Similarly, while the state of Chromebooks looks grim right now, especially given the amount of low-cost inventory, those numbers are likely to rise as schools ramp up their efforts to provide computers to students.

UPDATE: 2022/07/31 12:04 EST BY JULES WANG

To clarify

We’ve updated our story to include more context about the reported numbers and the OEMs involved.

[ad_2]

Source link