[ad_1]

Low index funds make it easy to reach average market returns. But in any diversified portfolio of stocks, you will see some that fall short of the average. That’s what happened TVS Srichakra Limited (NSE:TVSSRICHAK) share price. It’s up 61% in three years, but that’s below the market’s return. Looking at recent returns, the stock is up 16% year over year.

Since the stock added ₹ 2.3b to its market share last week, let’s see if the underlying activity has been driving long-term returns.

Our analysis shows that TVSSRICHAK may be overpriced!

While markets are a powerful pricing tool, share prices reflect investor sentiment, not just fundamental business performance. Another way to look at how market sentiment has changed over time is to look at the relationship between a company’s share price and its earnings per share (EPS).

Over the past three years, TVS Srichakra has failed to grow earnings per share, which is down 25% (year-on-year).

So we doubt that the market looks to EPS as its primary judge of a company’s value. Given this situation, it makes sense to look at other metrics as well.

Weakening at just 0.6%, we doubt the dividend is doing much to support the share price. It may be that TVS Srichakra’s revenue growth rate of 5.5% over three years has convinced shareholders to believe in a bright future. In such a case, the company may sacrifice current earnings per share to drive growth, and perhaps shareholders’ faith in better days ahead will be rewarded.

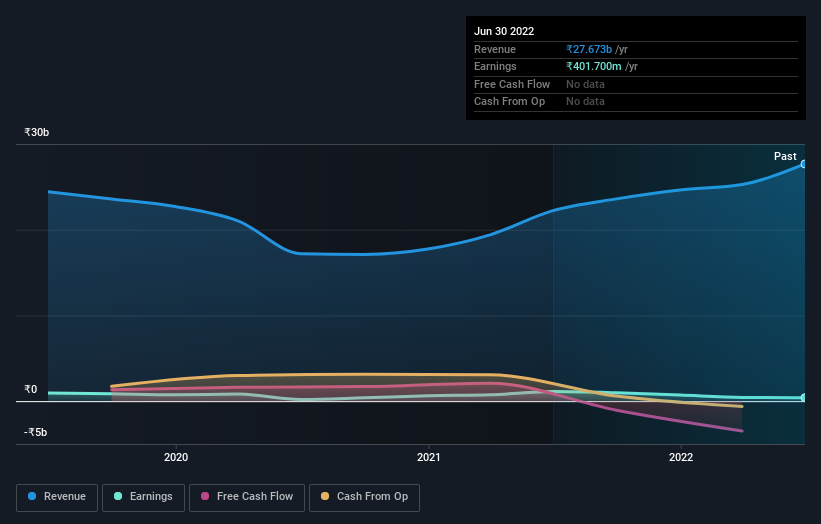

You can see below how revenue and income have changed over time (get the exact values by clicking on the image).

This for free The active report on TVS Srichakra’s balance sheet strength is a good place to start, if you want to research the stock further.

What About Dividends?

When looking at investment returns, it’s important to consider the difference between total shareholder return (TSR) and share price compensation. TSR includes the value of any spin-offs or capital raising discount, as well as any dividends, based on the assumption that the shares are reinvested. Of course, TSR gives a more comprehensive picture of the returns made by a stock. As it happens, TVS Srichakra’s TSR in the last 3 years was 67%, which exceeds the share price return mentioned earlier. Dividends paid by the company have therefore increased total shareholder returns.

A Different View

We are pleased to report that the shareholders of TVS Srichakra have achieved a total shareholder return of 17% in one year. Of course, that includes the dividend. That beats a loss of about 1.7% per year over the past half-decade. Long-term losses make us cautious, but TSR’s short-term gains certainly indicate a bright future. It is always interesting to track share price performance over the long term. But to understand TVS Srichakra better, we need to consider many other things. Until then, you should read about it 4 warning signs we have seen with TVS Srichakra (including 2 which does not sit well with us) .

For those who like to find successful investment this for free list of growing companies with recent insider acquisitions, may be just the ticket.

Please note, the market returns quoted in this article reflect the average returns of the markets currently traded on the exchange.

Valuation is complicated, but we help make it easy.

Find out if TVS Srichakra It may or may not be worth it based on our extensive, inclusive analysis fair value estimation, risks and caveats, dividends, insider trading and financial health.

See Free Analysis

Do you have an answer to this article? Worried about content? Hook up directly with us. Alternatively, email edit-team(at)easywallst.com.

This article by Simply Wall St is casual in nature. We provide commentary based on historical data and analyst estimates only using an unbiased approach and our articles are not intended to be financial advice. It does not make a recommendation to buy or sell any stock, and does not take into account your goals, or your financial situation. We aim to bring you focused long-term analysis driven by fundamental data. Note that our analysis may not include company announcements that look at recent price or quality materials. Simple Wall St has no position in any of the stocks mentioned.

[ad_2]

Source link