[ad_1]

Buy / Sell TVS Motor to share

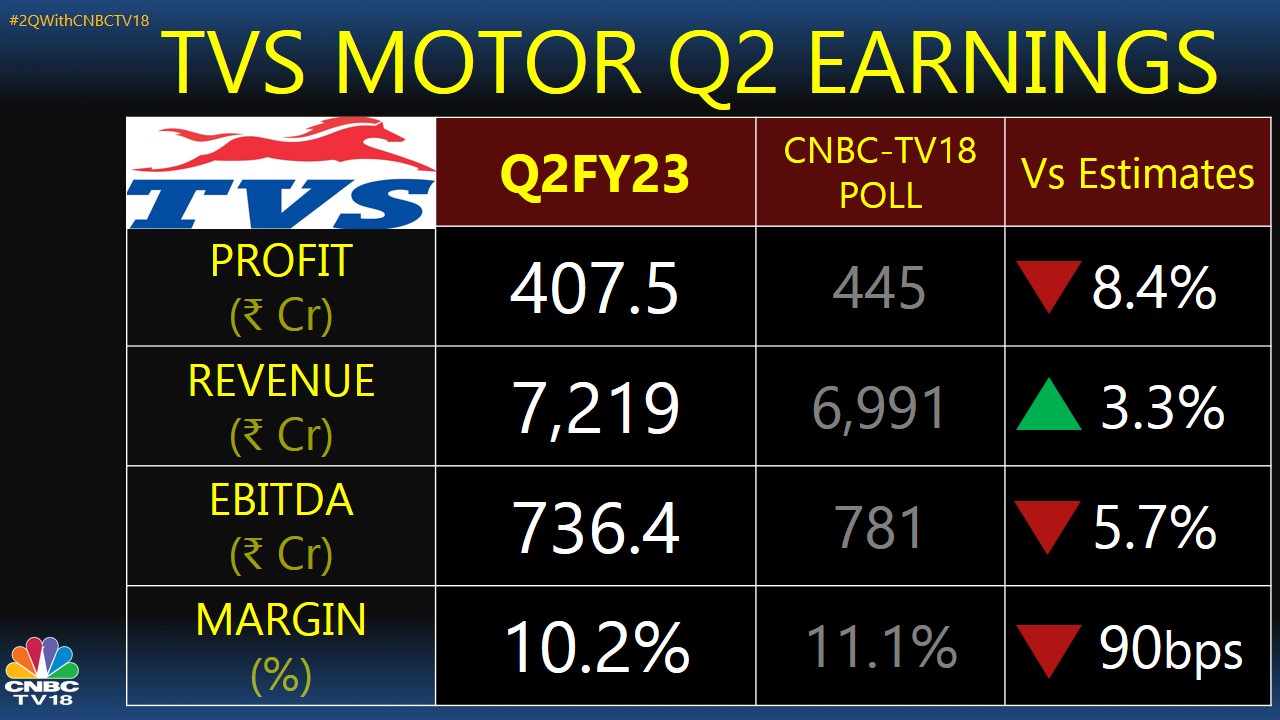

It’s a tug of war between bulls and bears over TVS Motor Company, after the two- and three-wheeler maker reported quarterly earnings that fell short of analysts’ expectations. On the capital side are Nomura, UBS and Macquarie, with CLSA and BofA Securities on the bear side.

Shares of TVS Motor recovered most of their intraday losses before ending just below the range on Monday.

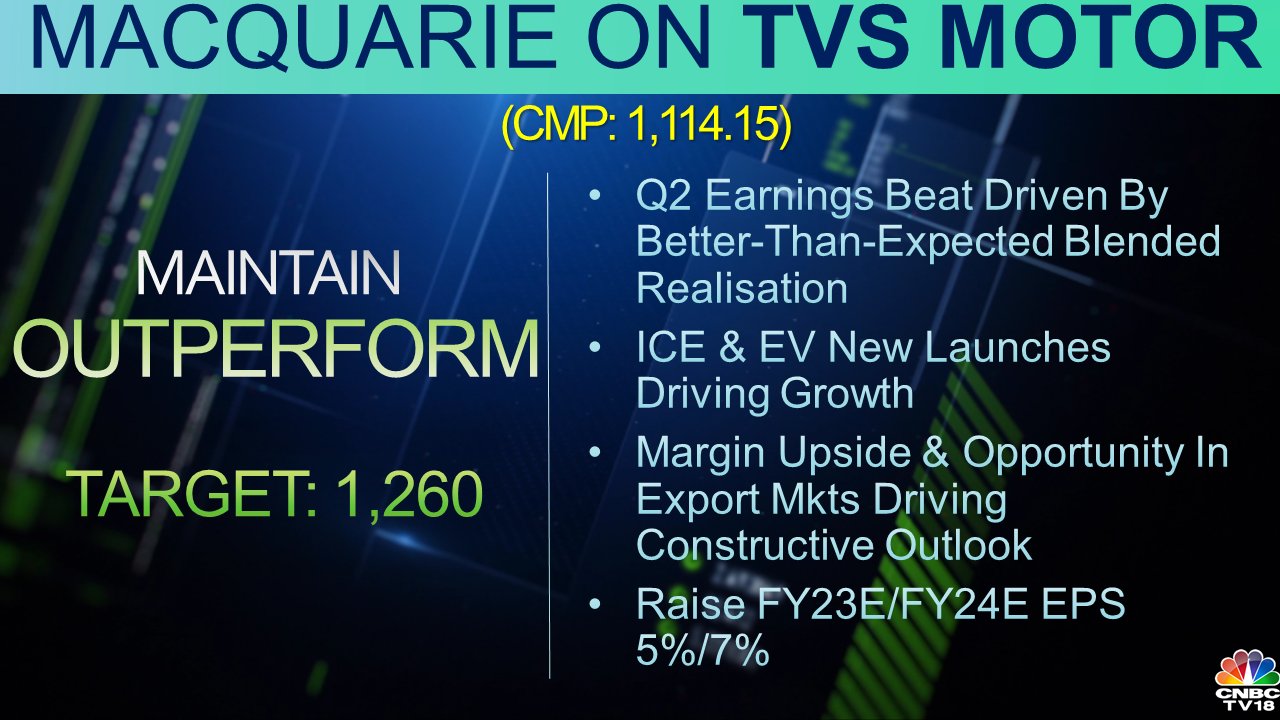

UBS has a ‘buy’ call on the stock and a target price of Rs 1,355 – indicating a potential upside of about 22 percent from the stock’s closing price on Monday. Nomura upgraded TVS Motor to ‘buy’ with a price target of Rs 1,382. Macquarie has an ‘outperform’ rating on TVS with a price target of Rs 1,260.

Brokerages are good at:

According to Nomura, export challenges are likely for TVS in the short term but the group will definitely overcome.

On the other hand, CLSA has a ‘sell’ call on TVS Motor stock with a target price of Rs 932. The brokerage finds the car maker’s valuation “overpriced” after the recent rally.

The stock trades at 30 times its earnings per share for the year ending March 2024.

BofA Securities downgraded the stock to ‘underperform’ with a price target of 1,030. The brokerage is of the opinion that the price has no room for error.

For more, watch the accompanying video

(Edited by: Sandeep Singh)

[ad_2]

Source link