[ad_1]

Also in this letter:

■ Twitter has started vacating flexible office space in India

■ Alibaba Group to sell 26.29 crore Zomato shares today

■ ETSA winner Exotel bets on traditional sector amid recession

The government will discuss the data bill with legal experts, academics this week

The government is scheduled to meet legal experts and academics this week and seek their feedback on the draft Digital Personal Data Protection (DPDP) Bill, 2022, sources aware of the development said.

Quick catch: After withdrawing an earlier draft of the bill in early August, the government released a revised draft for public consultation on 18 November. The deadline for sending responses is December 17.

Rajeev Chandrasekhar, Minister of State for Electronics and IT, held initial discussions with industry participants just a day after the draft was released for public consultation.

Agenda: The closed-door meetings this week are likely to be chaired by Union Electronics and Information Technology Minister Ashwini Vaishnav, our sources said.

Apart from seeking feedback, the government will “try to allay any apprehensions raised by experts on some controversial issues so far” on the bill, a source said.

Highlights: We reported on November 16 that the new draft proposes to allow data storage and transfer of Indians to “trusted” jurisdictions, which the government will define from time to time. The earlier draft said that data of Indians should be stored only in India.

The new draft also omits clauses on non-personal data, regulation of social media and auditing of hardware products.

On November 18, we reported that the revised bill calls for large fines for companies that commit data breaches or intimate users and the government for failing to contain such incidents.

It said that if any company, data fiduciary or processor handling users’ personal data fails to “adopt reasonable security safeguards to prevent personal data breaches”, they can be fined up to Rs 200 crore.

Twitter has started vacating flexible office space in India

After massive layoffs, Twitter is vacating its flexible office space in India.

Details: People familiar with the matter said the company has undertaken to vacate seats in Mumbai under its WeWork arrangement and is serving a three-month notice period.

Twitter has vacated its TEC space at One Horizon in Gurgaon and will vacate the seat there.

It has vacated around 150 seats across the two centres, our sources said.

Moved: The remaining employees of the Gurgaon TEC center have been shifted to the Mehrauli TEC center in Delhi, they said. Twitter’s marketing and policy teams operate out of this center.

The company has moved its entire communications team to India.

Pruning: Earlier this month, Twitter cut all teams in India and reportedly fired around 180 of its 230-odd employees here.

A message from APPSFLYER

AppsFlyer’s ‘MAMA India – The Digital Bharat 2.0’

Economic Times is partnering with Digital AppsFlyer to bring you MAMA India- ‘The Digital Bharat 2.0’, an invitation-only event that will bring together mobile app product leaders, mobile marketing influencers, startup founders, marquee investors and policymakers for guaranteed conversation. will educate and empower businesses to tap into the growth opportunities available in the increasingly mobile-first, app-centric Indian market.

“The Indian app economy is one of the fastest growing in the world and promises immense opportunities for growth as India realizes its vision of becoming a digitally empowered society through Digital India 2.0. AppsFlyer is committed to helping the Indian app ecosystem unlock its full potential. Mama India – The Digital Bharat 2.0 event is one such initiative to empower marketers, startups, product developers and innovators to tap into India’s fast-growing app economy,” said Ronen Mense, President & MD, APAC, AppsFlyer.

Alibaba Group will sell 26.29 crore Zomato shares today

Chinese internet giant Alibaba Group will sell 26.29 crore shares in food-tech platform Zomato – equivalent to a 3.07% stake in the company – for about $193 million in a block deal on Wednesday, according to a term sheet issued by investment banker Morgan Stanley, a copy of which we reviewed. I did

Details: The sale will take place at an offer floor price of Rs 60 per share – a 5.59% discount from Tuesday’s closing price of Rs 63.55 on the BSE.

According to Zomato’s shareholding pattern as of September 30, Alibaba Group affiliates Alipay Singapore Holding Pte Ltd and Antfin Singapore Holding Pte Ltd own a combined 12.98% stake in the company.

Alibaba Group first invested in Zomato in 2018 through Ant Financial, investing $210 million for a 14.7% stake, which was later increased to 23%.

Drop out: With this partial exit, Alibaba joins a list of Zomato investors who have sold the company’s stock over the past two years. Marquee shareholders including Sequoia Capital, Tiger Global, Uber and Delivery Hero sold or reduced their stakes in the company.

ET eCommerce Index

We have launched three indices – ET eCommerce, ET eCommerce Profitable and ET eCommerce Unprofitable – to track the performance of recently listed tech companies. Here’s how they’ve fared so far.

Exotel has bet on traditional sectors, bundling products amid recession

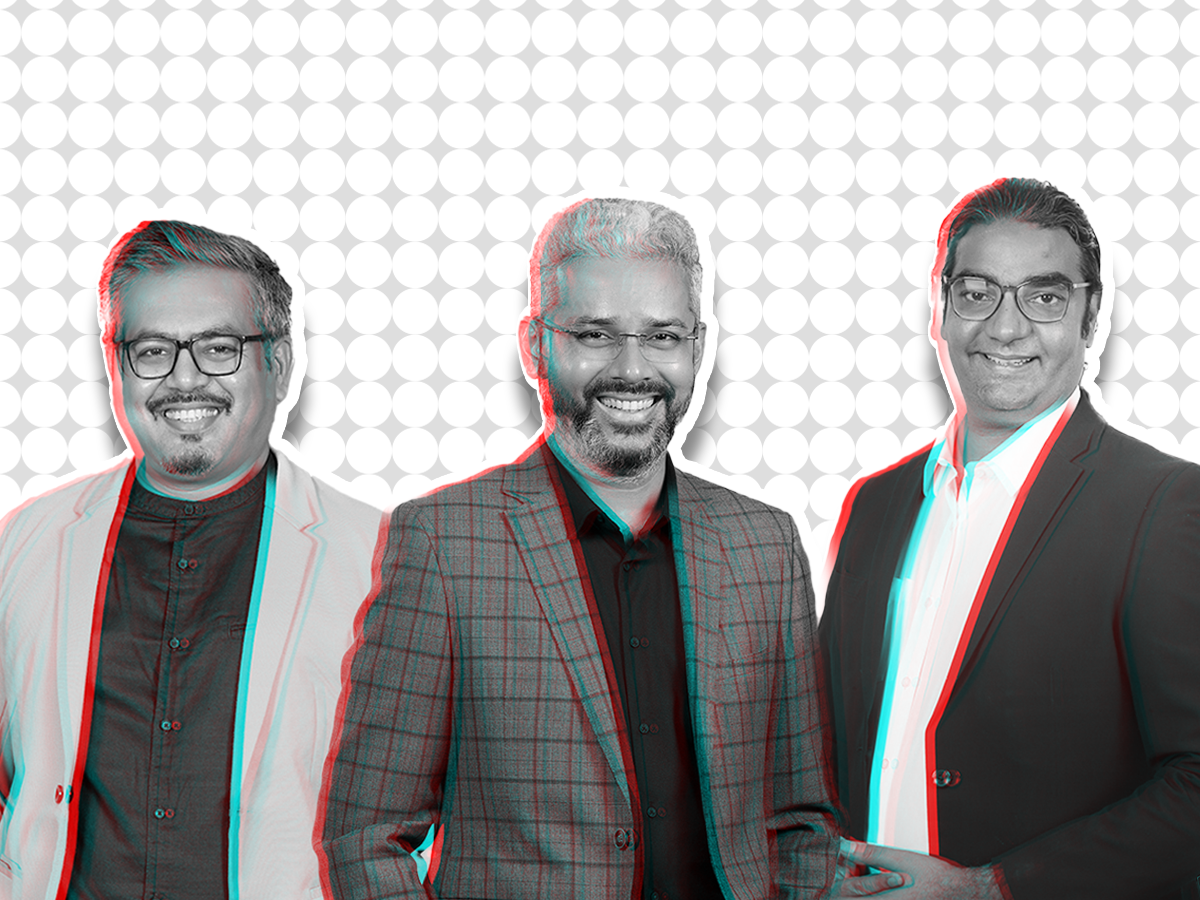

Exotel co-founders (from left) Ishwar Sreedharan, Sivakumar Ganesan and Sachin Bhatia

Cloud telephony and contact center technology provider Exotel is actively focusing on traditional segments like banking, financial services and insurance (BFSI) and consolidating its offerings to existing users as it seeks to beat macroeconomic headwinds, its founders told us. They also said the company plans to list on Indian stock exchanges by 2026.

ETSA Winners: Winner of the Comeback Kid category at The Economic Times Startup Awards 2022, Exotel is looking to end FY23 with an annual revenue run rate (ARR) of at least Rs 540 crore (about $66 million). In January, the company said its ARR was around $50 million.

Founded in 2011, Exotel is a customer engagement platform that helps businesses connect with customers across multiple channels. It has raised nearly $100 million to date and counts the likes of Steadview Capital, A91 Partners and Blume Ventures as investors.

Profit target: The company posted a profit of Rs 10.5 crore on revenue of Rs 119 crore in FY21, but recorded a loss of Rs 13.8 crore in FY22 due to disinvestment in its growth targets. The company is looking to break even next year and be profitable by the end of FY25.

Tweet of the day

Cred to buy credit as fintech consolidation continues

Fintech startup Cred said on Tuesday it has agreed to buy credit underwriting software provider Creditvidya for a mix of equity and cash. The acquisition is subject to necessary approvals from the National Company Law Tribunal (NCLT).

Between the lines: Credit has primarily focused on credit cards and people with high credit scores, while Creditology focuses on including first-time borrowers in the credit economy. Founded in 2012, it provides a loan underwriting platform that helps banks and non-bank financial institutions perform better credit assessments.

Consolidation time: The Indian lending sector is heading towards consolidation as the Reserve Bank of India’s (RBI’s) first set of digital lending rules – issued in September – emphasizes the role of regulated entities such as non-banks and reduces loan-distribution platforms to direct selling agents.

We reported on November 25 that digital payments major PhonePe is set to acquire pay-now platform ZestMoney.

Also Read | Prismforce has raised $13.6 million in a funding round led by Sequoia Capital India

Other top stories by our reporters

JP Morgan keeps a close eye on fintech innovations coming out of India: JP Morgan is keeping a close eye on fintech innovation coming out of India and sees the “incredible growth of innovation happening in the country” as a huge opportunity to collaborate across its ecosystem, said Laurie Bear, Global Chief Information Officer, JPMorgan Chase & Co.

Global Peaks we are reading

■ Brazilians flock to Indian platform Ku (Rest of the World) in Twitter drama.

■ Elon Musk’s Apple attack sets stage for public debate over risk for Apple, Twitter (WSJ)

■ China to send crew to its newly completed space station (The Washington Post)

[ad_2]

Source link